Resilinc predicts that if Chinese demand for US products materializes as projected, manufacturing companies in the US will begin to experience shortages, both of workers and raw materials. These shortages may jeopardize the ability of manufacturers to fulfill the increased demand.

Indeed, on the logistics side of the supply chain, labor shortfalls are already evident, as a lack of truck drivers leaves companies unable to meet current levels of demand for products made in the US—never mind those potentially inflated by China in the near future.

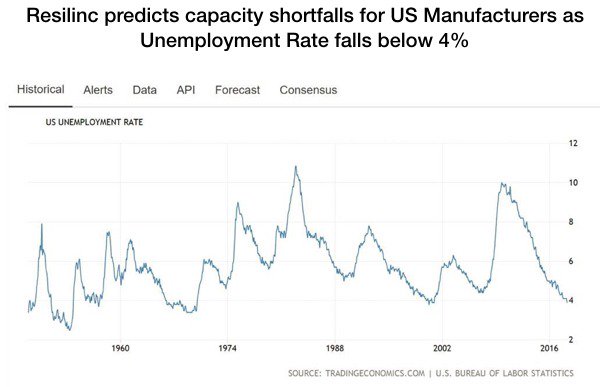

A Downward Unemployment Trend

Unemployment in April was 3.9%, the lowest it has been in 17 years. According to Trading Economics, unemployment in the US averaged 5.78% from 1948 to 2018, hitting a record high of 10.8% in November 1982 and an all-time low of 2.5% in 1953.

The reduction in unemployment resulted partially from a fall in labor force participation, which hit a three-month low of 62.8%. The Bureau of Labor Statistics expects the participation-rate reduction to continue, due to an aging US population. Therefore, the overall unemployment rate is likely to fall further, perhaps reaching 3.7% in 2019, according to FocusEconomics Consensus Forecast.

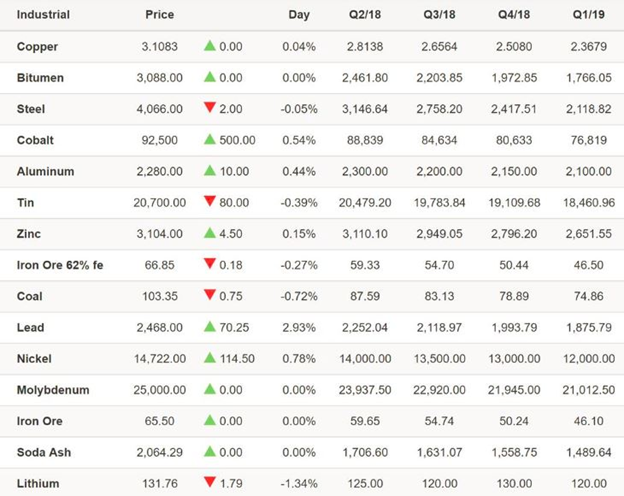

Commodity and Raw Material Prices on the Rise

While unemployment falls in the United States, the prices of many commodities and raw materials are escalating. Commodities like steel, aluminum, corrugated metals, diesel fuel, caustic soda, and their derivative products are becoming more expensive, driving manufacturing-cost increases in industries that depend heavily on these materials.

The April 2018 Manufacturing ISM Report on Business shows that the Price Index registered higher raw material prices for the 26th consecutive month. In addition, concerns exist about the uncertainty surrounding current and potential US-China tariffs, which continue to be a possible price risk on the horizon. Many companies have put expansion plans on hold (or slowed them down) in light of these uncertainties.

Source: Trading Economics Commodities Forecast 2018

Supply-side Concerns in the Spotlight

The ISM Manufacturing Report on Business also reveals that a slow-down in supplier deliveries created a backlog of orders. Current levels of demand are actually quite healthy, but most companies are unable to keep up due to supply-side issues.

Against this or any other backdrop, increased Chinese demand for US products can only be a positive development, yet the ability of US manufacturers to meet it is, at best, questionable right now. There is a real risk that the US manufacturing and export sector will miss a perfect opportunity to exploit Chinese demand—a demand that would help to counter record trade deficits and relieve the tariff-war scenario.

CEOs, Boards, Customers: They’re all watching!

CEOs and boards do not like to leave demand unfulfilled for any reason, with mismanagement on the supply side being no exception. The expectation is that supply chain leaders predict market developments, plan for them, and ensure the supply chain adapts to support growth opportunities.

In short, supply-side bottlenecks are not on the executive agenda and your human resources are not well-spent chasing shortages and resolving allocations under the shadow of constraints.

Aside from that, if your company falls into the pattern of placing customers on allocation, pushing out deliveries, and failing to comply with perfect order expectations, your customers will soon seek out alternative suppliers. You will always have competitors ready to promise what you fail to deliver—and a promise is often enough to prompt defections by unhappy customers.

Meanwhile, premiums paid for freight and raw materials erode margins and further curtail long-term growth opportunities for your organization, so these too, are issues to address preemptively, rather than as a response.

Fortune Favors the Informed…

It may not be a Chinese proverb, but perhaps it should be because the difference between leaders and laggards is that leaders plan and act pre-emptively. Those that evaluate market movements and trends will be planning for predicted outcomes now—and taking steps to ensure they can meet demand as it materializes.

Leaders invest in supply chain mapping and identifying suppliers and sites that have struggled to meet on-time delivery targets. They are also gathering capacity information and upside flexibility data from these sites.

Supplier and Site Capacity: A Good Place to Start

Resilinc’s Supplier Capacity Assessment tool can help you join the class of leaders that prepare their supply chains to dominate across a wide range of scenarios. We can help you quickly identify suppliers and sites operating at high capacity utilization rates and with less ability to add flex-capacity at short notice.

Armed with this vital information, your supply chain designers can spend their valuable time identifying and qualifying alternative, more readily capable sites, and sources—so your enterprise won’t miss any opportunity to profit from increased levels of demand.