On March 14, 2023, the U.S. Customs and Border Protection (CBP) launched the UFLPA Statistics Dashboard; a fully interactive dashboard that allows anyone to see the latest statistics on which industries have been impacted by the Uyghur Forced Labor Prevent Act (UFLPA). Using the dashboard, users can break down shipments by industry, quarter, and country of origin. To try the dashboard, check out this guide.

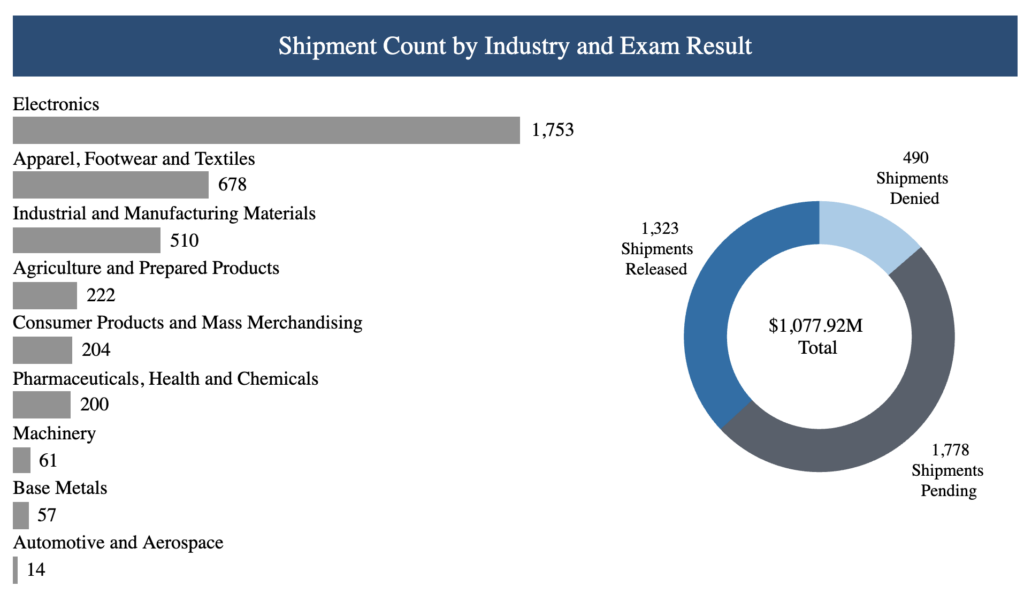

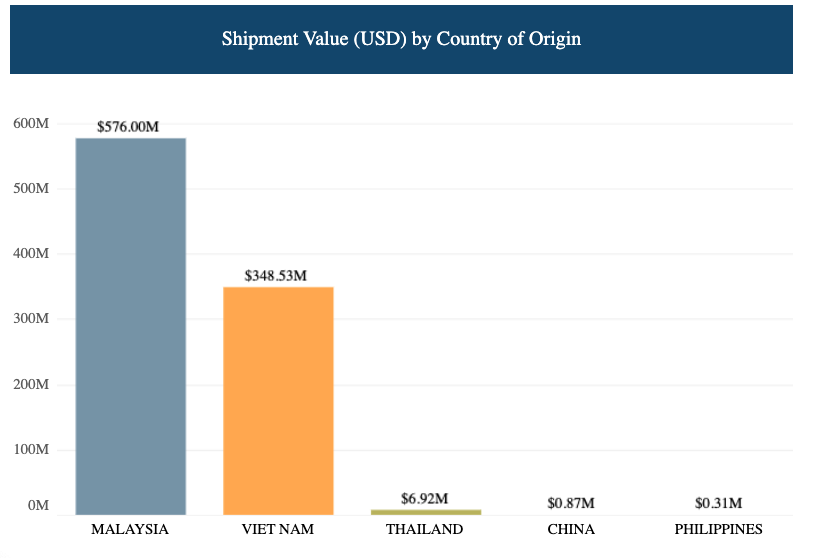

From Q3 2022 to Q2 2023, CBP stopped 3,588 shipments for further evaluation valued at $1,078 million mainly from Malaysia, Vietnam, China, and Thailand. Of those shipments, CBP denied 490 shipments (14%) and released 1323 shipments (34%) into U.S. commerce; the remaining 48% of shipments are still pending.

Since UFLPA went into effect in July 2022, the top three industries that had shipments stopped by CBP include: 1) Electronics; 2) Apparel, footwear, and textiles; 3) Industrial and manufacturing materials. In this blog, we’ll take a closer look at the supply chain impact of UFLPA and how industries are being affected.

#1 Electronics: Solar Panels and Automotive

Electronics accounted for 48% of all shipments stopped by CBP and 86% of the total value of shipments stopped by CBP, according to the dashboard. Notably, every single shipment from Malaysia detained by CBP fell under electronics. In total, 1042 shipments were stopped from Malaysia; almost 60% of all stopped electronics. As for the other countries, 38% of electronics came from Vietnam and nearly 1% came from Thailand.

Solar Panels

While CBP does not itemize which goods fall under “electronics”, it is speculated that the majority of detained electronics are solar panels—considering that polysilicon (a key solar material) is one of the high-risk materials targeted by UFLPA. Also, according to an analysis of the UFLPA dashboard from Bernreuter Research, data shows that 2GW of solar PV modules were likely detained by US customs based on price fluctuations seen through 2022.

Thankfully, in March 2023, U.S. imports of solar panels finally started to pick up as a result of clearer rules surrounding UFLPA. And, the future looks bright for US solar manufacturers. Announced on April 20, 2023, the Biden-Harris administration plans to invest $82 Million to increase domestic solar manufacturing and recycling to strengthen the American clean energy grid.

Automotive

U.S. customs noted that “the electronics industry encompasses more than just solar panels”. In an interview with Shahzaib Khan, Senior Director of Product and Data at Resilinc, Shahzaib commented, “Our customers, which include some of the largest hi-tech organizations out there, are mainly worried about electronic parts because 10% of the polysilicon supply is used in electronic parts. Automotive, aerospace, and healthcare industries—all of these industries use parts that contain polysilicon.”

Specific to automotive, in December 2022, Senate Finance Committee Chair Ron Wyden sent letters to major automakers Ford, General Motors, Honda, Mercedes-Benz, Stellantis, Tesla, Toyota, and Volkswagen. Wyden stated, “I recognize automobiles contain numerous parts sourced across the world and are subject to complex supply chains. However, this recognition cannot cause the United States to compromise its fundamental commitment to upholding human rights and U.S. law.”

Wyden requested responses to questions like, “Does your supply chain include any raw materials, mining, processing, or parts manufacturing linked to Xinjiang?” To avoid penalties from UFLPA, automakers should perform due diligence by sending out supplier assessments. Read more about how Resilinc is helping companies (and automakers) with UFLPA compliance here.

Learn more in Resilinc Special Report about the current state of the silicon market, forced labor impacts, cost, and production changes, and the actionable steps to ensure UFLPA compliance in your supply chain. Read the report.

#2 Apparel, Footwear, and Textiles: Fast Fashion

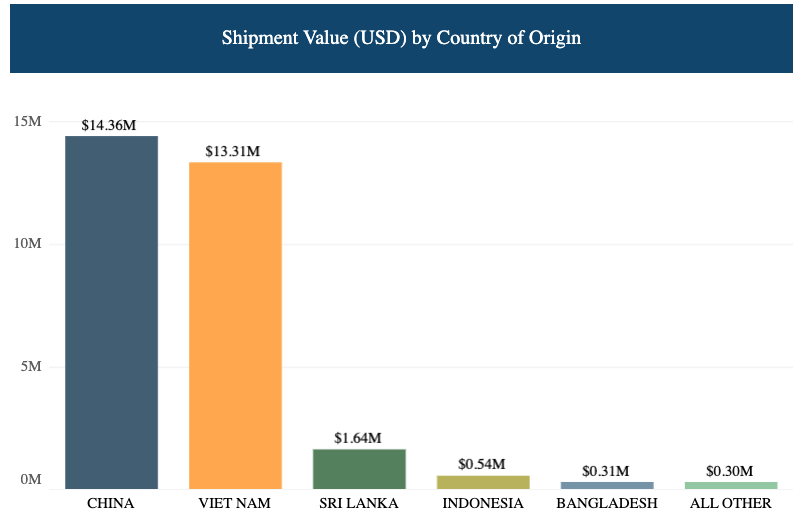

According to the UFLPA dashboard, apparel, footwear, and textiles made up 19% of detained shipments, but only about 3% of the total value of all shipments stopped due to UFLPA. Apparel, footwear, and textiles saw the highest number of shipments stopped in Q1 2023; 73%. As for the country of origin, 40% of apparel, footwear, and textile shipments came from Malaysia and 57% from China; this category was the number one detained category from China.

UFLPA may be having an impact on cotton in the US. The Xinjiang region produces about 90% of China’s cotton, making much of Chinese cotton product exports potentially susceptible. In 2022, US cotton imports were down after reaching the highest level in a decade. However, even with UFLPA in place, China remained the largest cotton product supplier for the 20th year in a row. And, while cotton imports were down, cotton product imports were $8B higher compared to 2021.

Currently, U.S. politicians worry that fast fashion companies (such as Shein and Temu) are evading the legislation by directly shipping from China to consumers. As a result, politicians are asking for more information on how UFLPA is enforced for small dollar-amount shipments. In the near future, there may be updates to UFLPA to account for bad actors who try to skirt the law.

#3 Industrial and Manufacturing Materials: Aluminum

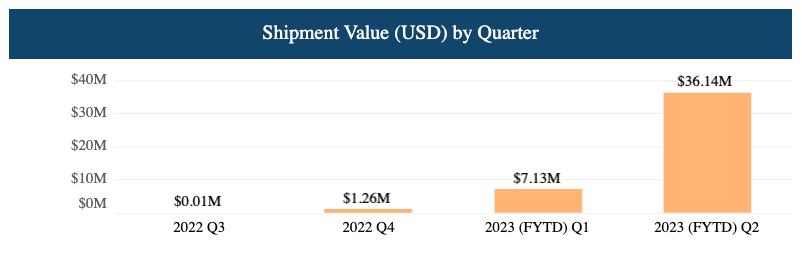

Industrial and manufacturing materials made up 14% of all shipments stopped by CBP and accounted for 4% of the total value of all detained shipments. 51% of the goods came from Vietnam and 49% came from China. Industrial and Manufacturing Materials have increasingly been stopped by CBP; seeing a 406% increase from Q1 2023 to Q2 2023. In fact, 81% of all industrial and manufacturing material shipments that were stopped, were stopped in Q2 2023.

Why have Industrial and Manufacturing Materials been on the rise? Initially, CBP highlighted three high-risk commodities: cotton, polysilicon, and tomatoes. These goods have a high-risk of having ties to forced labor and thus are prioritized by CBP.

However, in January of 2023, CBP started to issue detention notices naming a fourth sector: aluminum. According to the UFLPA FAQ, UFLPA also identifies “apparel and silica-based products, including the raw materials used to make aluminum alloys, silicones, and polysilicon, as high-priority sectors for enforcement.” While it was not officially announced, it appears U.S. Customs has started to crack down on aluminum as well starting in 2023.

It’s worth noting, the US also recently imposed new tariffs on aluminum imports from Russia. As of March 2023, there is a 200% duty on “aluminum articles that are the product of Russia and derivative aluminum articles that are the product of Russia.” While aluminum imports from China and Russia are under scrutiny, Canada is the main supplier of aluminum to the US; accounting for nearly 40% of all aluminum imports to the US in 2021.

Other Affected Industries Impacted by UFLPA

Behind the top three categories are Agriculture and Prepared Products (6%); Consumer Products and Mass Merchandising (5%); and Pharmaceuticals, Health, and Chemicals (5%). At the bottom of the list, the categories with the least number of shipments are Machinery (2%); Base Metals (1%); and Automotive and Aerospace (with only 14 shipments total).

Agricultural and Prepared Products are most likely comprised of tomatoes. Tomatoes were specifically identified as a high-risk commodity by UFLPA since the Xinjiang region grows 80% of China’s tomatoes. However, this is not a major category for detainments since the US does not import many tomato products from the Xinjiang region. Most US tomatoes come from California, Mexico, and Canada.

Are These Products in Your Supply Chain?

While UFLPA targets the Xinjiang region of China; Vietnam, Malaysia, and Thailand are frequently intermediaries — using raw materials from the Xinjiang region. Here is a snapshot of which regions and goods are at risk based on the data from the dashboard:

- General: apparel, cotton, tomatoes, polysilicon, and aluminum

- Electronics made with polysilicon (particularly from Malaysia)

- Apparel, footwear, textiles (particularly from China)

- Industrial and manufacturing materials (particularly from Vietnam and China that contain aluminum)

To find out exactly where your parts and products come from, Resilinc recommends mapping your supply chain (ideally down to the third tier). Once you identify suppliers who may be at risk, send out supplier assessments to perform due diligence and have evidence in case your products are stopped by US customs. In the event you find a supplier that has ties to the Xinjiang region of China, you can act quickly and find a new supplier.

Check out this interview with Resilinc’s Senior Director of Product and Data to learn how Resilinc is helping companies across all industries stay ahead of the curve for UFLPA compliance.