An early March decision by the Belgian Council of State (equivalent to the U.S. Supreme Court) to shut down a Belgium-based 3M plant is anticipated to bring fresh turmoil to the semiconductor industry: likely shortages of specialized coolants. Coolant is a key input in chip manufacturing.

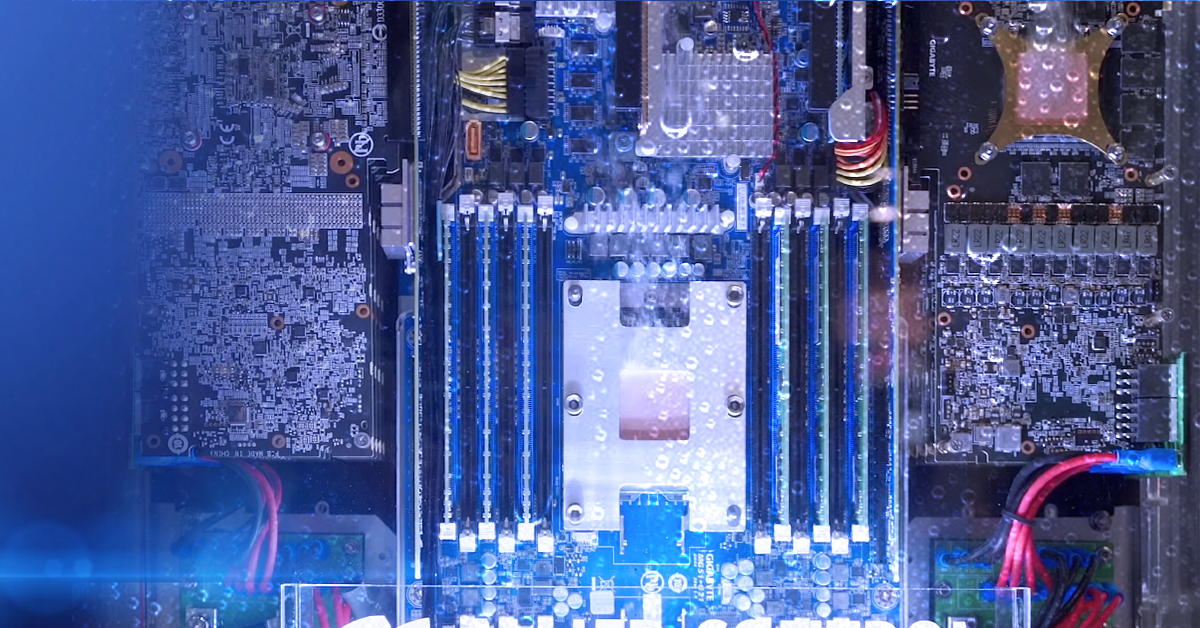

3M’s Zwijndrecht, Belgium, plant produces coolant that is essential to the etching process used in semiconductor manufacturing. Nearly two years ago, Belgian environmental regulators directed 3M to reduce and remediate the plant’s discharge of PFAS chemicals—contaminants known as “forever chemicals” because of how long they persist in water and soil—to reflect new scientific understanding of the chemicals’ impacts on human health. 3M reduced production at the plant last year, while appealing the tighter regulations. After losing the recent court decision, the company announced a €150 million remediation effort, but specifics about the timing and when coolant production would resume weren’t publicly available.

According to business media and a special report by Resilinc supply chain analysts, the 3M plant was responsible for about 80% of certain types of specialized coolants (3M Fluorinert and 3M Novec) used by semiconductor manufacturers worldwide. 3M accounts for 90% of this type of coolant production: its Belgium plant accounts for 80% of production and its US plant accounts for 10%. On March 18, 3M informed customers – including Samsung, SK Hynix, Intel and TSMC – of impending shortages. Depending on inventory levels, these and other large semiconductor manufacturers may have between one month and three months’ supply of the specialized coolant on hand, according to Resilinc’s analysis.

And, it’s likely supply chain disruptions associated with tighter regulations of PFAS chemicals will continue, especially in Europe. Belgium, for example, is urging an EU-wide ban on use of the substances.

According to Cooling Post, a trade journal for the refrigerant industry, Germany, the Netherlands, Sweden, Norway, and Denmark are also pushing the EU to restrict the use of PFAS used in manufacturing common refrigerants HFC and HFO. After a delay, new regulations will likely be published in January 2023, followed by stakeholder consultation. If approved by the EU parliament and council of ministers, the new PFAS regulations would go into effect in 2025.

Careful monitoring of emerging environmental regulations should be a part of every supply chain risk management (SCRM) program. It’s also worth mentioning that the 3M coolant plant is an example of a single source upon which an entire industry depends for a key input. While the impacts of the current disruption may not amount to extensive disruptions, it stands as a testimony to the importance of rigorous and thorough supply chain mapping to identify hidden lower-tier dependencies, as well as mitigation strategies such as finding alternate suppliers or adjusting production methods to use more commonly available chemicals.

Read special report: Semiconductor Impacts: Coolant