In 2023 so far, Life Sciences has surprisingly had the highest number of EventWatchAI alerts of any industry tracked by Resilinc. In this Q&A, we sat down with Craig Fix, Resilinc’s Senior Director of Customer Success, to discuss why this is happening and how it is impacting the entire industry.

Craig is a veteran practitioner in Life Sciences with nearly 30 years of experience and was Resilinc’s first Life Sciences customer, giving him a unique perspective on the latest challenges. Read on to hear Craig’s expert insights on the current landscape and what companies can do to accelerate supply chain resilience in the midst of increased supply chain disruptions.

***

Tell us a bit about your background in Life Sciences. Do you currently work primarily with Life Sciences clients at Resilinc?

I have nearly 30 years of experience as a global procurement and supply chain leader in High-Tech and Life Sciences. About eight of those years in Life Sciences were spent at the world’s largest dental products company, where I was responsible for global procurement.

In 2011, after the Japan tsunami destroyed one of our most critical sole suppliers, it created a call to action in the company to invest in a sustainable approach to proactively mitigate risk. We needed to position our organization and supplier base to act quickly to secure supply in the event of a disruption. I identified and selected Resilinc to enable our supply risk management and mitigation strategy and was the first Life Sciences customer of Resilinc in January 2013.

One year ago, I decided to join the Resilinc Customer Success organization to lead the team that supports our Life Sciences customer base. I help my customer base realize the value that comes from their partnership with Resilinc during their supply resilience journey. Over 75% of my customer base are biopharma and medical device customers.

Life Sciences has had more EventWatchAI alerts than any other industry so far this year. What are some of the largest issues challenging the Life Sciences industry right now?

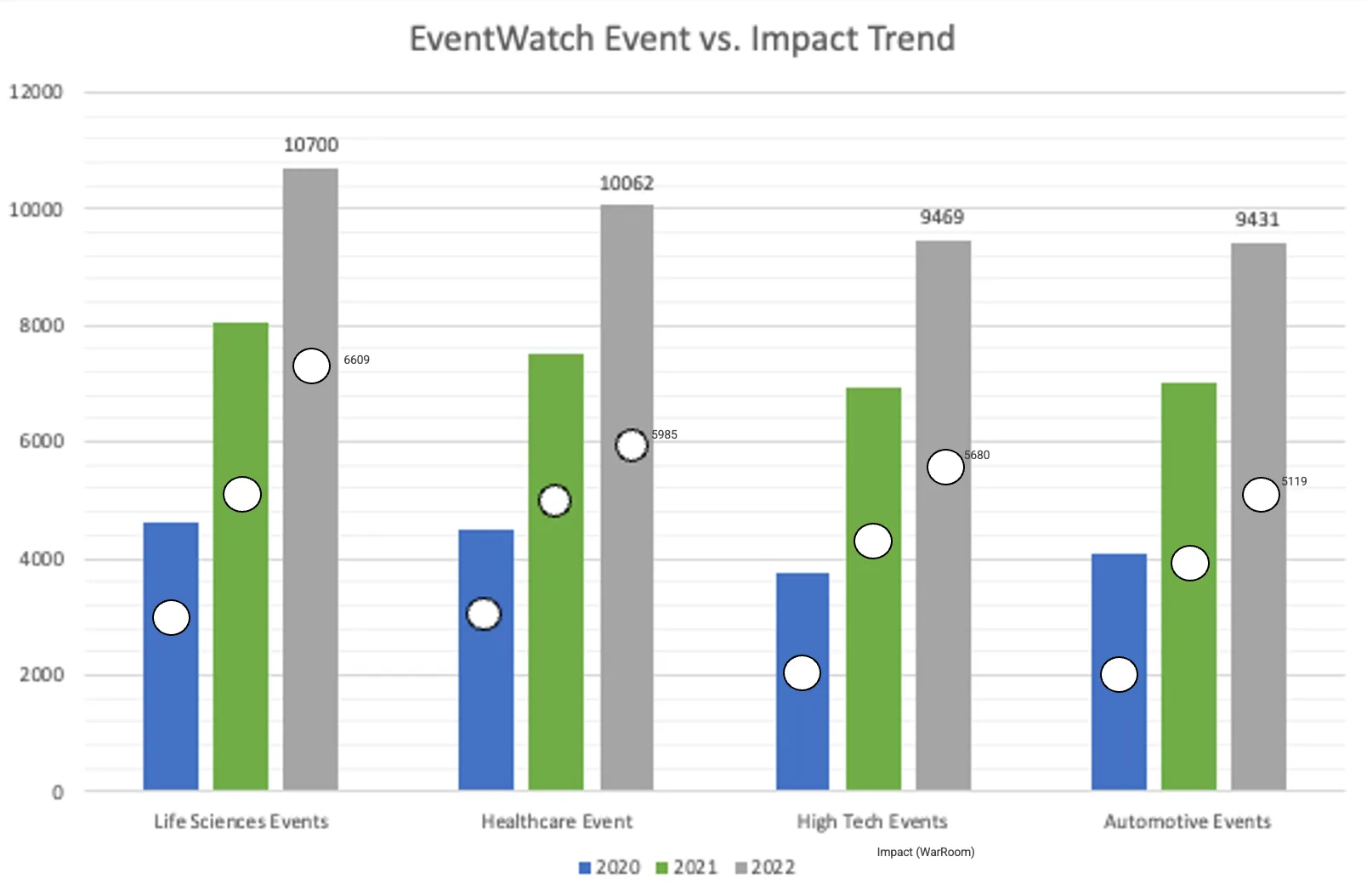

The number of annual EventWatchAI alerts approximately doubled since 2020 to about 10,700 in 2022. Of those alerts, 60% typically had some kind of impact reported by a supplier. For Life Sciences, 80% of the pain point areas we see come from business transitions (mergers and acquisitions, business sales, and senior leadership changes), factory fires, recalls, legal actions, extreme weather, natural disasters, and supply shortages.

For example, in 2023, the top 10 Pharma and Life Sciences acquisition deals totaled more than $83 billion, the largest being Pfizer’s acquisition of Seagen. This doesn’t include activity related to spin-offs, such as Labcorp’s spin-off of Fortrea, which closed in Q3.

Life Sciences organizations are also working to respond to ESG-related challenges more proactively. They are looking at how to prepare for climate risks that could potentially impact their sub-tier supply chain in the years to come.

How is the Life Sciences industry different post-COVID?

I’ve seen an increase in the number of large and medium-sized Life Sciences companies that are investing in supply chain risk management. Before, these companies did not have robust analytical solutions for creating visibility and managing suppliers. Now, they are investing in proactive risk mitigation to control their supplier, site, and component risk vulnerabilities. Companies are also investing in digitizing their supply chain data, so they can integrate supply risk, purchasing spend, compliance, and material data as a part of their overall procurement control tower.

There is also accelerated work to reduce dependency on India and China for bulk APIs and generic drugs. Another strategic focus has been on regionalizing the supply of critical materials and investing in continuous and more flexible manufacturing capabilities. However, reliance on third-party suppliers for many materials and APIs in higher-risk countries will continue. As a result, continuing to invest in SCRM and creating sub-tier visibility is something that Life Sciences companies must continue to do.

Working as a practitioner in Life Sciences and at Resilinc, what has the journey to supply chain resiliency looked like for the companies you have worked with?

Achieving supply chain resiliency across a globally diverse, multi-business group enterprise is strategic and includes leading change management internally and externally (with suppliers). It has to become embedded in the processes of sourcing, strategic category management, purchasing, compliance and supplier development. As someone who has implemented—and now supports customers at Resilinc—the journey is somewhat different depending on the company size, organizational structure, culture, and product technology factors. In general, however, here are the steps I’ve employed and recommend for building supply chain resiliency.

The journey starts with a good understanding of the problem and opportunity at hand. In this early stage, partner with an expert like Resilinc to leverage their experience when getting started. This partnership can help define the right operating model for your business and build an implementation plan. Perhaps most importantly, working with a supply chain risk management partner can help communicate the business case to the C-Level and SVP-level to secure sponsorship and governance.

Scaling implementation selectively and steadily vs. a ‘big bang’ works the best from my experience. Piloting a small subset of the supplier base can help demonstrate the operational aspects of the business case internally and test engagement with suppliers. This can also help inform or confirm the approach to scaling implementation in order to set expectations for the program internally. Establishing and embedding SCRM across the enterprise and cross-functionally with the support of tier-one and targeted sub-tier suppliers is a change management effort. Start with business groups, categories, and suppliers that are willing to adopt changes the fastest. This will create quick wins and establish momentum to power through any organizational speed bumps.

Along the path of the resilience journey, I have experienced numerous situations that created delays and changes to our planned path (e.g., acquisitions, internal business group priority changes, senior leadership change, and budget pressure). It takes commitment, flexibility, re-education, and sometimes, senior executive sponsorship to overcome these changes to avoid losing progress resulting in pockets of adoption.

What do CPOs and procurement professionals in Life Sciences need to think about for the future?

As you can see from the chart below, over the last three years, Life Sciences and Healthcare industry verticals have experienced a high and increasing trend in events. They have also experienced the highest number of EventWatchAI alerts and impact confirmations. Geopolitical, regulatory, environmental, and reshoring trends (to name a few), stand to pose further supply risk challenges for procurement in the future.

Since CPO’s are typically concerned with at least three areas like supply continuity (revenue), total cost (margin) and supplier development/relationships, I would suggest that they work closely to collaborate with suppliers to ensure that their sourcing and supplier development strategies and processes incorporate the ability to sense, assess, respond and mitigate risk.

Consider total cost impact. In addition to providing visibility for disruptive events, EventWatchAI can also provide early indicators of negative costs that can result, like higher costs due to the use of material brokers, expedited freight, or increased pricing needed to influence suppliers to deliver.

EventWatchAI visibility enables an organization to respond quickly and secure supply. Because supply continuity can be maintained, businesses are able to meet customer demand. Ensuring supply continuity enables the organization to maximize shipments and revenue while mitigating costs noted above

If procurement leaders have not yet considered implementing a supply chain risk management strategy, they should soon—as their customers and competitors are already looking to do so.

***

Ready to start implementing a supply chain risk management strategy? Learn more about how Resilinc helps Life Sciences companies gain sub-tier visibility to deal with the ESG and sourcing challenges currently affecting the industry. Check out Resilinc’s supply chain solutions for Life Sciences.

For more exclusive information on the latest challenges in Life Sciences, download Resilinc’s Special Report: State of Drug Shortages and Recalls in 2023 – Key Insights and Proven Strategies. Inside we discuss the top pharmaceutical drug shortages, notable recalls, and steps to increase supply chain visibility using AI mapping.