In early 2016, Facebook-owned Oculus brimmed with confidence following scores of pre-orders on January 6th for its highly-anticipated $600 Oculus Rift virtual reality headset. Oculus founder Palmer Lucky told attendees at CES 2016 that “Preorders are going much better than I could have ever possibly expected. I can’t talk about numbers, but we sold through in 10 minutes what I thought we were going to sell through in a few hours.”

In early 2016, Facebook-owned Oculus brimmed with confidence following scores of pre-orders on January 6th for its highly-anticipated $600 Oculus Rift virtual reality headset. Oculus founder Palmer Lucky told attendees at CES 2016 that “Preorders are going much better than I could have ever possibly expected. I can’t talk about numbers, but we sold through in 10 minutes what I thought we were going to sell through in a few hours.”

While preorders went better than they expected, what was a competitive NPI window for the VR pioneers quickly snowballed into a botched launch within a few months due to “unexpected component shortages,” leaving the Rift’s avid early-adopters furious, their deliveries pushed back months after the initially promised delivery dates of late-March. In a key window that can potentially leave scars on a new company’s brand, the recent delays shed light on how aligning a company’s Supply Chain and Procurement with Design early on is crucial when rolling out a successful new product introduction.

Early Adopters Angry with Lack of Communication

“The lack of communication and supply chain problems are mind-boggling for a company that has been working on its product for two and a half years,” says J.P. Gownden, analyst at Forrester Research. While that may sound a bit harsh, many whose deliveries were delayed til June had much harsher words (see the Oculus Reddit page). The VR community is undoubtedly vocal.

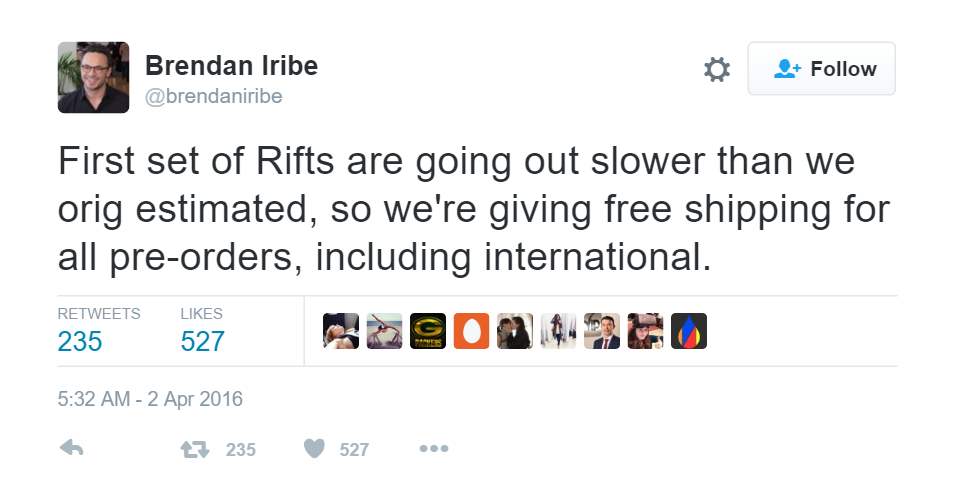

Oculus remains tight-lipped regarding the reasons for their components shortage, perhaps because the virtual reality race is in full force (see: HTC, Sony, GearVR). What is known, however, is that the Rift’s complex design is comprised of 200 custom parts, likely from single-sourced suppliers, according to RoadtoVR. In an email informing buyers of the delay, Oculus stated it has “taken measures to address the component shortages and increase manufacturing capacity,” and CEO Brendan Iribe tweeted that customers would receive free shipping to compensate for the delay – a costly and reactive way to appease a frustrated yet captive audience.

Don’t Make The NPI Tougher Than It Needs to Be

As with any NPI, successfully launching a new product into the market involves a number of demanding, mosaic tasks, each vitally connected to the one preceding it. Far too often, great product ideas fall short of expectations because one or more tasks are deprived the necessary level of attention. Furthermore, the lack of communication and collaboration between vital company departments increases the possibilities of “unexpected” setbacks (e.g. component shortages). But by saying “unexpected” after the fact, it implies ‘bad luck’ when in fact it was the byproduct of a strategic failure.

Procurement has to be established before production starts. It can’t afford to be a retrospective fit — it has to meet the needs of the product.

According to Value Stream Guru, early involvement of procurement within the design and launch of any new product can reduce the costs involved by up to 20%, which is a significant saving cost saving in addition to a proactive approach to managing risk. It can be tempting to simply get things moving, get the product ready to market, get it sold and then worry about getting procurement involved; then any costs reduced later on in the process when the dust has settled.

A great concept and design will fall on its face if you can’t procure the components in a timely and reliable manner, or if critical processes and required tooling are not known up front and communicated to suppliers. On the same hand, a company could have sturdy suppliers but overburden them with unrealistic manufacture demands, heighten the potential for supplier capacity and manufacture issues, and then walk away with the misconception that the supplier was inherently risky. When the right hand doesn’t know what the left hand is doing, how can one expect a smooth outcome?

5 Key Questions for the CEO

In many regards, OEMs have traditionally treated supply chain design as an issue separate from the synchronous design of the product and manufacturing process. Following the concept design phase, purchasing and procurement departments would then embark on an ongoing hunt for the lowest cost components by establishing an ideal balance between capacity and production costs, supplier facility location, and transportation and logistics costs. As such, supply chain performance would often be measured in oversimplified, unproductive, and sometimes counterintuitive terms.

That said, here are five critical questions to address during your NPI process:

- Is your supply chain team tuned in at the beginning of the NPI process?

- Who actively influences the procurement of components – the design team or the purchasing team?

- Do your suppliers’ suppliers have the capacity to meet future quality, delivery and volume demands?

- Does your company have visibility into its multi-tier supplier base, capabilities, and intelligence at the part and site level?

- Upon product launch, can you ensure sufficient inventory levels, a predictable lead time, and well-established supplier relationship to prepare for further ramping?

Resilient Innovation: Collaborate Earlier In The Design Process

Managing risk and resiliency in the NPI is as tantamount as with a mature company and product line. By collaborating with the procurement and supply chain functions, the design engineers are able to focus on the technical requirements and testing, while the supply chain organization validates and determines the appropriate suppliers to fit the new conceptual requirements. This synergy enables resilient innovation of new products.

When the supply chain function is equipped with the best-in-class supply chain visibility capabilities, they are able to identify risks beyond their tier-1 suppliers at the part and site-level earlier, validate supplier capability and capacity, and make strategic sourcing decisions. Armed with this supply chain intelligence, the supply chain department can chime in earlier in the design process, e.g. suggest alternate suppliers capable of meeting the requirements of a demandingly innovative product. As such, preventing a costly backtrack or delivery complication is much easier when you have data-driven analytics and supply chain intelligence inform your sourcing, supply chain, and even design decisions.

As touched upon in our previous blog post, Designing for Resiliency in both the product design and supply chain network creates opportunities in the design and development phase of a new product to identify known or potential supply chain risks to product plans. With an NPI (and a new company, at that), there’s much more on the line than just revenue losses tied to supply chain issues: brand damage, customer dissatisfaction, loss of market share to up-and-coming competitors.

After all, you don’t want to infuriate your early adopters. For better or for worse, they are your product’s first ambassadors.

{{cta(‘993bcd94-486f-4f39-8c36-571dde2293b5’)}}