Download the full 2018 annual report

The only certainty with Brexit is uncertainty. As this report was being finalized, Great Britain and the European Union had not reached a trade agreement ahead of the March 29 Brexit deadline. This meant that every company importing or exporting across UK/EU borders was facing possible new tariffs as high as 4.5%—multiplied by two or three for products that cross borders multiple times.

Even more damaging than tariffs could be delays at the border crossings. According to an analysis by Dr. Ke Han of Imperial College London’s Center for Transport Studies, shared on a Resilinc webinar in 2018, queues of trucks as long as 30 miles could materialize at Britain’s two busiest ports of entry, the Eurotunnel and Port of Dover. With 30% of Britain’s food entering through these two ports, delays would result in significant losses of perishable goods.

The Automotive Industry would be particularly hard hit by a “no-deal” Brexit. Delays like those described above would disrupt the “just-in-sequence” inventory practices used by some UK automakers—practice even more finely tuned than just-in-time procedures.

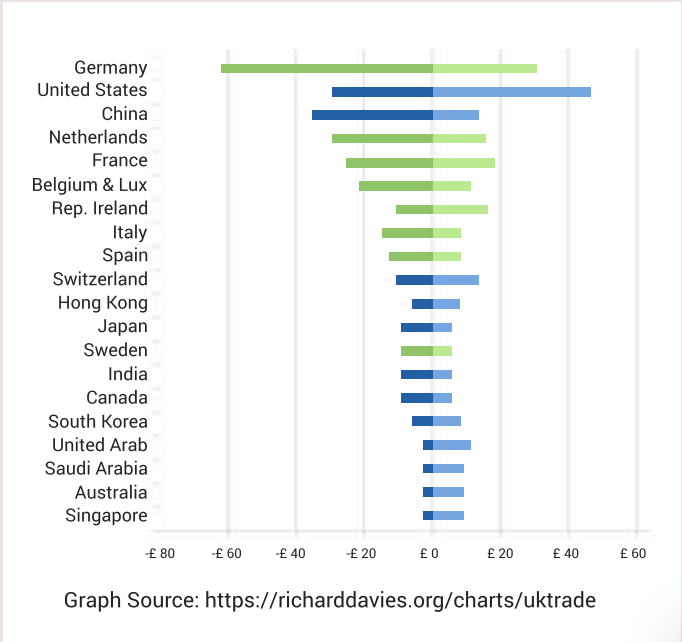

With gross profit margins of between 5% and 10%, automakers’ margins would be significantly eroded by tariffs—especially for parts that cross the UK borders more than once, a common scenario, especially between the UK, Germany, the Netherlands, France, Belgium and Luxembourg (see chart below).

Additionally, many automakers rely on a large percentage of small- to medium-sized enterprises (SME) sub-suppliers. For Automotive and Aerospace, SMEs represent 60% to 70% of the supplier base, according to Dr. Han. And by virtue of their smaller size they are less prepared for Brexit than larger enterprises. Indeed, many have never traded outside the EU.

By the end of March 2019, much more will be clear about the actual costs and burdens of managing supply chains in a post-Brexit world. The most well prepared for the variety of possible outcomes will likely be companies that have engaged in comprehensive analyses of their supply chain vulnerabilities through all tiers—including best-case and worst-case scenario planning and evaluation of the costs and time required to switch sourcing to non-UK suppliers.

Along with its challenges, Brexit presents a unique opportunity for supply chain professionals to underscore with senior management—who are already concerned about Brexit—the value of continuous supply chain improvement.

The UK’s largest trading partners

Total trade ( goods and services ), 2015, £bn

Brexit impacts you may not have considered:

• Potential impacts of varying regulations and like REACH some suppliers may not support UK market

• Access to people with appropriate skills: UK loss of talent

• Data protection islands

• Distribution changes and contingencies

• Financial stress on SME suppliers within your supply chain

• Transparency and counterfeit good