In the recent study “Global Claims Review 2015: Business Interruption in Focus,” Allianz Global Corporate & Specialty (AGCS) reported that increased interdependencies in global supply chains have led to a significant increase in business interruption-related insurance claims over the past five years. Analyzing over 1,800 business interruption claims from 68 countries from 2010 to 2015, the study found fires and explosions accounted for nearly 60% of those claims and that the average BI insurance claim now exceeds $2.4 million, 36% higher than the corresponding average direct property damage claim. Fires and explosions are particularly disruptive to sectors with high levels of interconnectivity and concentrations of risks in single locations, such as automotive, semiconductor, and petrochemicals, among others.

The Tianjin explosions dominated this year’s loss activity and highlighted the necessity of strategic business interruption (BI) and contingent business interruption (CBI) insurance coverage, especially for disruptions that originate from technical or human error. But CBI insurance is not a panacea for addressing key fire and explosion risks in your supply chain and doesn’t guarantee a business will avoid resulting financial loss from sub-tier disruptions and their rippling impacts. More large businesses are recognizing the importance of supply chain event monitoring, visibility, and risk management measures to help to inform their CBI insurance policies and minimize income losses from day-to-day disruptions through proactive mitigation.

Fighting Fire: The Top Loss Driver

According to the five-year study, fires and explosions accounted for the lion share of the surveyed BI property damage insurance claims at 59%. On the other hand, storms were the second top loss driver but only accounted for a mere 6% of the BI claims. Only 12% of the BI property damage claims originated from natural catastrophes while the other 88% were traced back to technical or human errors. This will come to a surprise to many that have the perception that natural catastrophes are the top business loss driver for businesses to seek coverage.

As many large businesses have shifted their manufacturing and production operations overseas to China and the rest of Asia, factory fires and explosions at supplier and sub-tier premises are an increasingly common occurrence. Numerous factors may have contributed to the increased frequency and severity of disruptive fires and explosions, from less adherence to regulations to higher instances of unskilled labor and faulty machinery. Much to the chagrin of large businesses, factory fires often occur below the tier 1 suppliers and often go undetected and unmitigated, lengthening time-to-recovery and increasing losses.

Case in Point: The Tianjin Explosions

The Tianjin explosions were a tremendous blow to global supply chains, affecting entire sectors across the board. At the world’s 10th largest port, operations were brought to a standstill amidst the chaos, impacting the flow of materials and products in and out of China. Chinese government censors actively removed and restricted information regarding the blasts, making it harder for companies to determine their impacted suppliers. Home to countless direct and indirect suppliers to large businesses across industries, Tianjin became a CBI reinsurance nightmare.

According to the AGCS study, the Tianjin explosions were the largest man-made insurance loss in 2015. Confirmed insurance industry losses via company announcements have already reached $2 billion, although many reinsurance brokers believe the total insured loss could exceed $3.3 billion. However, we must consider that these figures only represent direct insurance losses, and are not representative of the inventory and profit losses faced by countless businesses whose indirect suppliers were affected by the disaster. While ownership of the product in transit can be clearly defined when companies enter into a trading agreement, there can still be ambiguities about who owns what and when exactly.

From a CBI reinsurance standpoint, the Tianjin disaster is one of the most complex non-natural catastrophes to understand and untangle financially. It was an unexpected event and the explosion’s footprint was much larger than anticipated.

BI and CBI Insurance Limitations

Business interruption insurance does not necessarily safeguard a business from incurring income loss following a supply chain disruption. Contingent business interruption (CBI) insurance is an extension to a BI insurance policy designed to cover an insured’s business income loss from the loss, damage, or destruction of property owned by others, which includes direct suppliers and direct receivers of the product or service. However, CBI insurance typically only provides coverage for the direct relationship between the insured company’s suppliers or receivers, which can create a rift in coverage for companies involved in multi-tier supply chains. Indirect suppliers, which can comprise a large portion of a supply chain, are usually not covered. In many cases, businesses may be unaware of the indirect suppliers bolstering their direct suppliers and end up paying tremendous policy premiums.

Let’s suppose a fire or explosion interrupts operations at an indirect supplier’s premises. That interruption in turn causes a disruption to the insured company’s direct supplier. Ultimately, this causes an income loss to the “insured” business. Since the direct supplier did not experience direct physical damage per se, the otherwise insured business’s CBI policy would likely exclude coverage for the income loss in this case.

Businesses must acknowledge the limitations of CBI insurance to manage business income losses following supply chain disruptions like fires and explosions. Clearly, CBI insurance is critically important to the health of a company’s supply chain, but it’s no panacea for the increasing levels of risk posed to global multi-tier supply chains.

Bridging the CBI Insurance Gap with SCRM

Despite the prevalence of disruptions like fires/explosions and the aforementioned limitations of traditional BI and CBI insurance policies, there are numerous steps and measures a business can take to help prevent profit and product loss whilst treating and mitigating risk. Implementing supply chain risk management measures can help you avoid additional CBI insurance policy premiums.

Companies can use a broad array of indicators to pick up on potential problems with suppliers. For example, vetting your supplier for a track record of fires/explosions can guide the selection of a primary and alternate supplier. Consider monitoring the competitors of your suppliers to see developments or problems within the industry environment of your suppliers.

Supplier capacity management helps businesses prepare for inevitable disruptions by analyzing and proactively mitigating supplier capacity risks. It involves gathering supplier intelligence at the company, product, part, and process level in order to detect capacity disruptions before they happen.

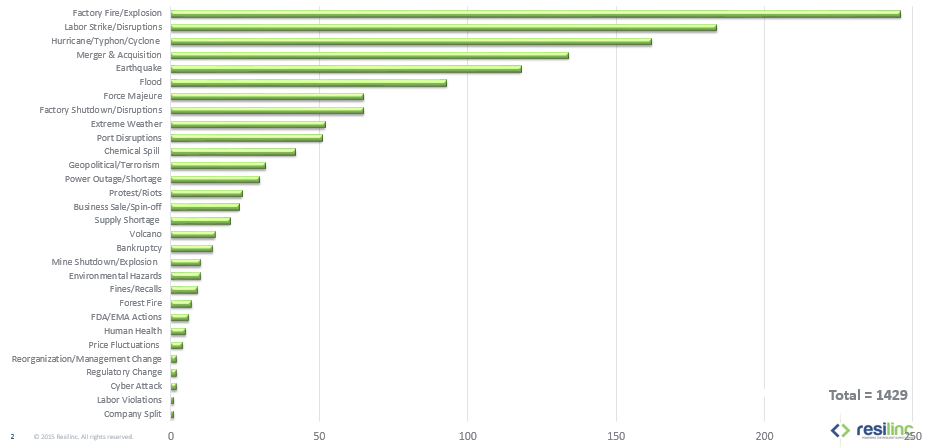

Supply chain event monitoring services enable businesses to quickly identify relevant disruptions, decrease response times, and reduce time-to-recovery. Since disruptions like factory fires are usually reported at the local level, it’s necessary to analyze multi-lingual feeds to identify disruptions that would have otherwise gone unnoticed. For example, Resilinc’s EventWatch supply chain event monitoring service provides tailored email reports with meaningful impact insights from a wide scope of disruption events. As seen in the graph below, factory fires and explosions are EventWatch’s top notified event.

Ultimately, the AGCS study’s findings indicate the growing need for companies to achieve supply chain visibility. Fires often occur in the clandestine pockets of a supply chain and it’s the disruptions that a company doesn’t see that can end up affecting it the most. Supply chain network mapping can aid in developing a precise CBI insurance policy that covers as many bases as possible. Building a global supply chain resiliency program can keep your supply chain out of the fire. Don’t get burned – get resilient.

References

- AGCS, Global Claims Review 2015: Business Interruption in Focus – AGCS

- Business Interruption Claims are on the Rise as Companies Contend with Interconnected Global Supply Chains – Businesswire

- Business Interruption Insurance: 8 Terms to Help You Understand What is Covered – Marsh